Business Insurance in and around Fort Worth

Fort Worth! Look no further for small business insurance.

Insure your business, intentionally

- Fort Worth

- Keller

- Haslet

- Haltom City

- Watauga

- Roanoke

- Justin

- Rhome

- Trophy Club

- Southlake

- North Lake

- Prosper

- Baton Rouge

- Dallas Fort Worth

- Saginaw

- Grapevine

- Colleyville

- North Richland Hills

- Richland hills

- Irving

- Arlington

- Lewisville

- Frisco

- Argyle

Help Prepare Your Business For The Unexpected.

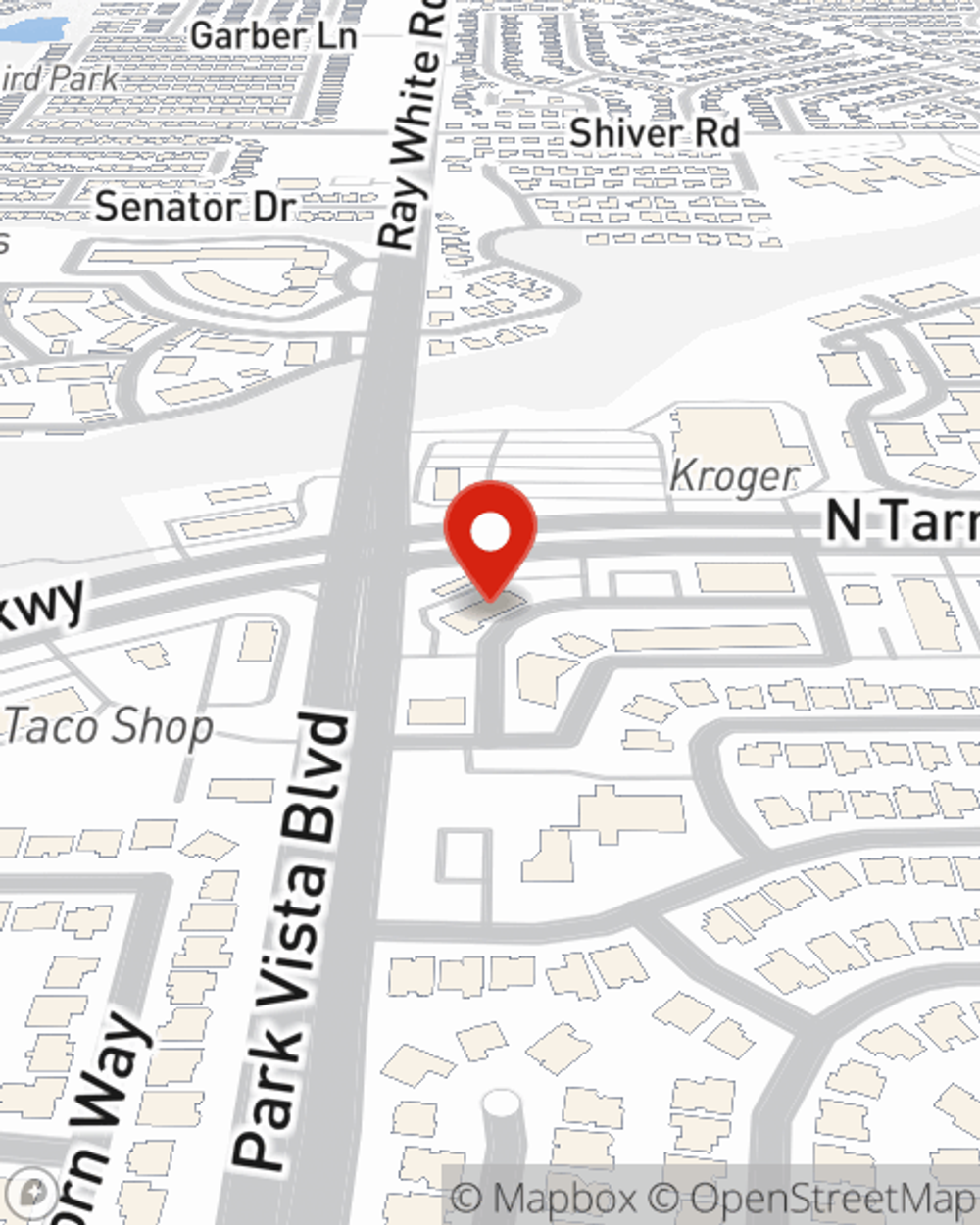

When you're a business owner, there's so much to remember. You're in good company. State Farm agent Matt White is a business owner, too. Let Matt White help you make sure that your business is properly insured. You won't regret it!

Fort Worth! Look no further for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

For your small business, whether it's an acting school, an antique store, an arts and crafts store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like buildings you own, business property, and computers.

Visit State Farm agent Matt White today to learn more about how one of the leaders in small business insurance can ease your worries about the future here in Fort Worth, TX.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Matt White

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.